i advisory

is a hybrid company and network. We offer consultancy and asset management services in capital markets with a clear focus on front office and trading since 2002.

Connecting technology innovation to human insight is what let us propel your ventures forward. Support from markets analysis and electronic trade negotiation to regulatory pre-transparency and near-time reporting.

Hybrid means we both enable customers and do business through our own company and our network partners. Hybrid technically means we are able to transact via traditional voice, FIX and new electronic, cloud-based channels.

Enabling business means in more detail: Treasury, trading, sales and risk management support across all asset classes – projects subject matter expertise and interim assignments. From new product approval, position keeping, ALM, risk management, accounting to management- and regulatory reporting including latest MiFID pre-trade transparency.

Independent and objective advice on critical capital markets issues. Getting your things done.

i BOR Transition

Until USD- and GBP-LIBOR become unusable, institutions already take active steps to meet timelines and milestones set out by ARRC and Sterling WG.

We support with implementing front office best practices, assessment of exposures and P&L, transition of protocols, risk management and accounting readiness.

Structured information overview can be best found on the ISDA pages, Bloomberg had been selected to calculate and publish adjusted RFRs as fallbacks, delayed also available to the public. The NatWest Markets pages also offer comprehensive information and a RFR Calculator. ISDA and Clarus FT have recently published an RFR adaption indicator measuring trading activity in new rates.

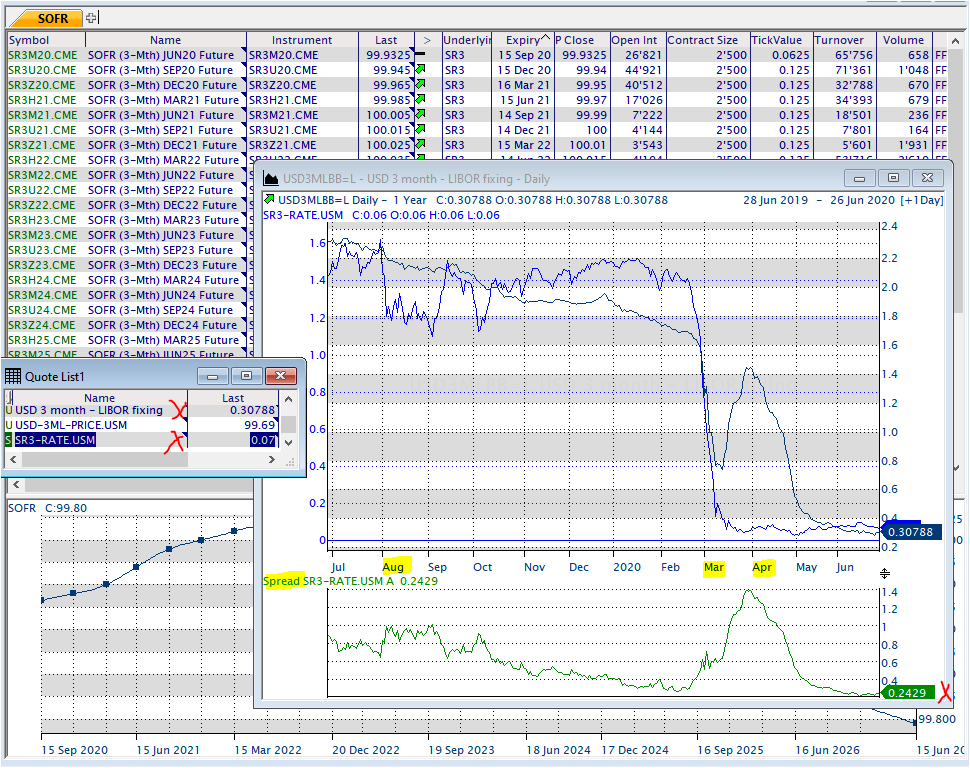

Shown below is an example how to define user rates in FIS MarketMap with few mouseclicks. Here, for comparison of Libor and SOFR implied rate, the front month’s last price is subtracted from 100. User defined instruments are a nice feature for monitoring spreads, basis, indexes and also creating ideas.

i M

Days to IM Phase 5, initial margin (“IM”) exchange requirements under the uncleared margin rules. On 3 April 2020 BCBS and IOSCO announced a one year extension, the revised Phase 5 deadline now is 1 September 2021, Phase 6 is 1 September 2022. If you are looking for hands-on support to getting things done for Phase 5/6, we would be happy to assist!

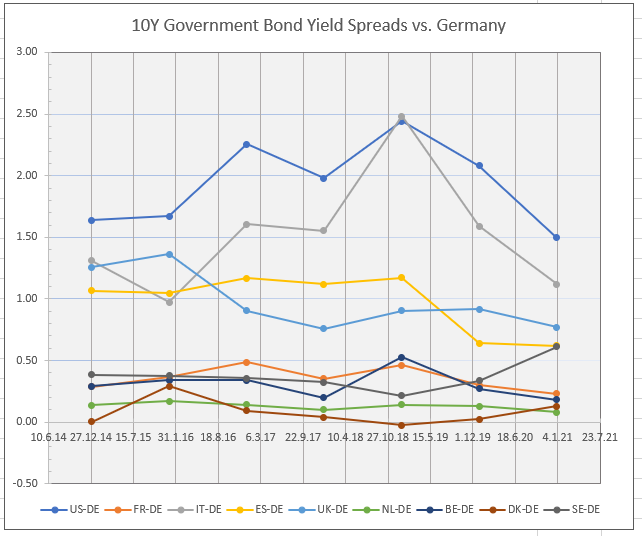

i Common Spreads

Below shown are few regularly monitored basic intra- and inter market spreads in the front office. Demos found on our public websites may illustrate we understand your products, market data environment and current project revenue challenges.

| 10Y Spreads | US-DE | FR-DE | IT-DE | ES-DE | UK-DE | NL-DE | BE-DE | DK-DE | SE-DE |

|---|---|---|---|---|---|---|---|---|---|

| 2023-02-17 | 1.38 | 0.46 | 1.82 | 0.98 | 1.07 | 0.33 | 0.58 | 0.21 | -0.06 |

| 2019-12-31 | 2.08 | 0.3 | 1.59 | 0.64 | 0.92 | 0.13 | 0.27 | 0.03 | 0.34 |

| 2018-12-31 | 2.44 | 0.46 | 2.48 | 1.17 | 0.91 | 0.14 | 0.53 | -0.03 | 0.22 |

| 2017-12-29 | 1.98 | 0.35 | 1.55 | 1.12 | 0.76 | 0.1 | 0.2 | 0.04 | 0.32 |

| 2016-12-30 | 2.26 | 0.9 | 0.36 | ||||||

ipushpull license expired -> Replace all other Excel-Links with Table Press Plugin as above.

i Capital Markets Consultancy

Comes since 2002 from the trading floor, not from the classroom. We are practitioners, learners, driven by innovation. Engaged, involved, implementation-oriented, well connected. We deliver clear, concise and actionable business requirements.

We support your front- and middle office, your project teams and also your vendors. An early example on fixed income autohedging can be found here.

i Valuation

We support the buyside with independent analysis and valuation. Next to using trading systems and Excel Add-in’s we have built our own toolbox over the years, in particular utilizing Excel & MS SQL-Server, also used for own data storage and spread monitoring.

i Spreads: 10y Government Bond Yields

i Clients

Are banks, institutional investors, german and japanese corporates, other consultancies.

i Network

Comprises experienced managers in capital markets and trading, (trading-) technology professionals, accounting specialists, colleagues at vendors and their implementation partners.

i.advisory’s network insights can help you set the course.

i JAPANCONSULT

Need support for your business development or sales activities JP – DE? Please visit our JAPANCONSULT offer.

i Memberships

PRMIA | The Professional Risk Managers’ International Association

DJW | The Japanese-German Business Association

i Next Events

We are supporting customers during E-world Essen in February 2024. If you are around, please drop us an email to meet with us.

If you consider visiting Cologne Anuga in October 2023, please contact Makiko Yoshihara (Veltmann) for assistance, from organising your stay in Germany to interpreting during the fair.